April 2024 Newsletter

Art: Honey, why is everyone so exhausted on April 1st?

Wendy: Because they just finished a 31-day March.

Friends,

It’s hard to believe our son turned 16 on Easter Sunday yesterday. Our daughter is an aspiring actress, my wife is a genius and I’m one of the luckiest guys alive. The photo above is us at "MJ the Musical."

Another reason I’m grateful is that I love what I do for a living and I appreciate all of my Medicare clients. A special thank you to the 126 clients who have now been with me for over 10 years.

Finally, 20 years ago today I met my wife Amy at her office party celebrating 5 years in business, so that means today is her 25th work anniversary. Congratulations Amy and The Healing Touch Wellness Center on 25 years in business! https://healingtouchct.com/

There's so much to be thankful for.

Kind Regards,

Michael Antonini

What’s New

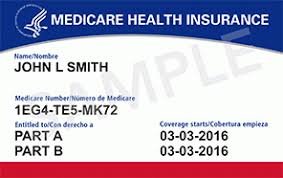

Here are 3 tips to protect yourself from Medicare fraud and scams:

If you get a call, text or email asking for your Medicare Number, DON’T RESPOND. Don’t give your Medicare Card or Number to anyone except your doctors or people you know should have it.

Check your Medicare Summary Notices (MSN’s) or claim statements carefully. If you see a charge for a service you didn’t get or a product you didn’t order, it may be fraud. If you suspect fraud, report it at 1-800-MEDICARE.

Guard your Medicare card as if it were a credit card.

The New June 2024 Medicare Supplement rates for AARP and Humana were just announced. The Humana Supplement N is now one of the least expensive ones in the state and if you live with a spouse it’s even 12% less. Humana offers Silver Sneakers too.

If you would like to discuss making a change from your current Anthem or AARP supplement you can in April or May. Also, if you are still on Plan F please consider Plan G. The G is the same as the F except it has a $240 annual deductible and is a lot less in premium cost per month.

Here is a link to the latest rate sheet.

Ask an Expert: IRS.GOV

Tips to help last-minute taxpayers:

The tax filing deadline is just around the corner. If you’re still working on your tax return, these tips may help you complete your return accurately and timely:

• File electronically: IRS efile is available to all taxpayers and many can e-file their individual tax returns for free. Last year, nearly 100 million taxpayers opted for the safest, fastest and easiest way to submit their individual tax returns — IRS e-file.

• Check the identification numbers: Carefully check identification numbers — usually Social Security numbers — for each person listed. This includes you, your spouse, dependents and persons listed in relation to claims for the Child and Dependent Care Credit or Earned Income Tax Credit. Missing, incorrect or illegible Social Security numbers can delay or reduce a tax refund.

• Double-check your figures: If you are filing a paper return, double-check that you have correctly figured the refund or balance due.

• Check the tax tables: If you e-file, the software will do this for you. If you are using Free File Fillable Forms or a paper return, double-check that you used the right figure from the tax table for your filing status.

• Sign your form: You must sign and date your return. If you’re filing a joint return, both you and your spouse must sign it, even if only one of you had income. If you paid someone to prepare your return, they must also sign it and enter their Preparer Tax Identification Number.

• Send your return to the right address: If you are mailing a return, find the correct mailing address at www.irs.gov.

• Pay electronically: Electronic payment options are convenient, safe and secure methods for paying taxes. You can authorize an electronic funds withdrawal or use a credit or a debit card.

• Follow instructions when mailing a payment: People sending a payment should make the check payable to the United States Treasury and should enclose it with, but not attach it to, the tax return or the Form 1040-V, Payment Voucher, if used. The check should include the Social Security number of the person listed first on the return, daytime phone number, the tax year and the type of form filed.

• File or request an extension of time to file: By the April 15 due date, you should either file a return or request an extension of time to file. Remember, the extension of time to file is not an extension of time to pay.

Important Dates

April 1: 25th Anniversary of the Healing Touch Wellness Center

April 5 & 6: Head over Heels – Regional Center for the Arts -

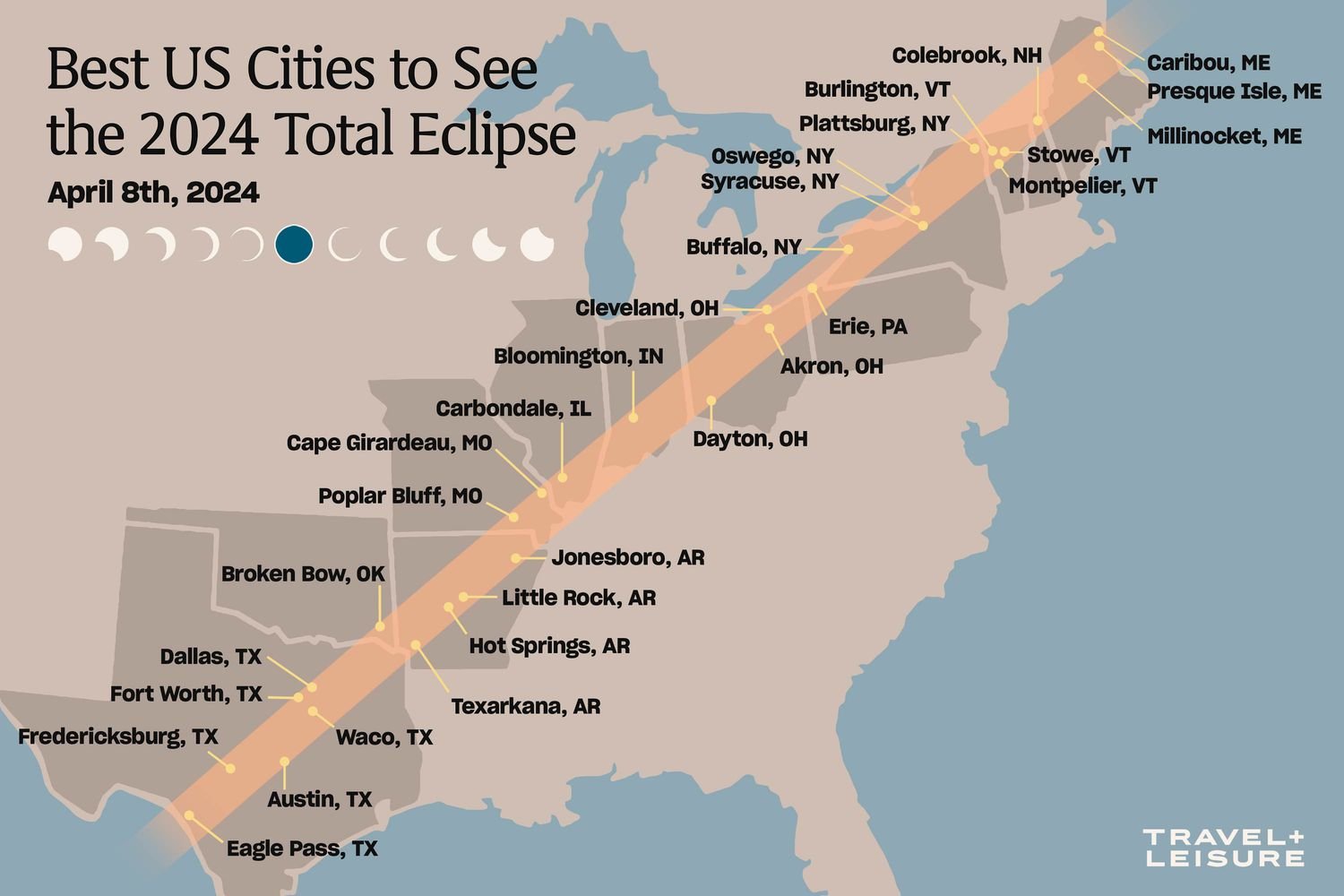

April 8: Total Lunar Eclipse Next one August 12, 2026

April 7-11: Antonini family trip to Washington, DC. I will be unavailable for a few days, returning calls on Friday, April 12.

April 15: Tax deadline

April 23: Full Pink Moon, for more info, click here.

Happy Birthday and Anniversary to everyone celebrating in April!

Don’t forget to call or email if you would like me to review your Medicare Supplement policy, especially if you are on Plan F.

All the Best,

Michael Antonini